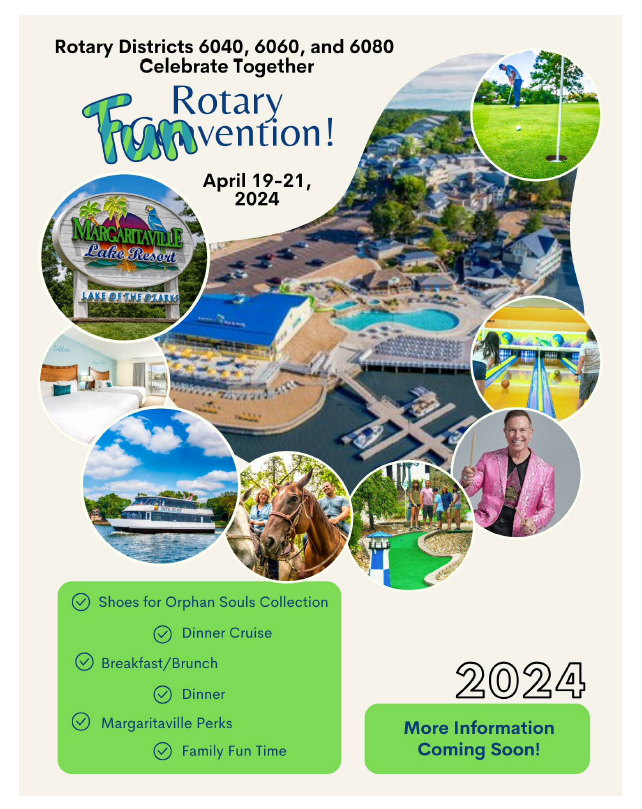

23rd Year of Shoes for Orphan Souls

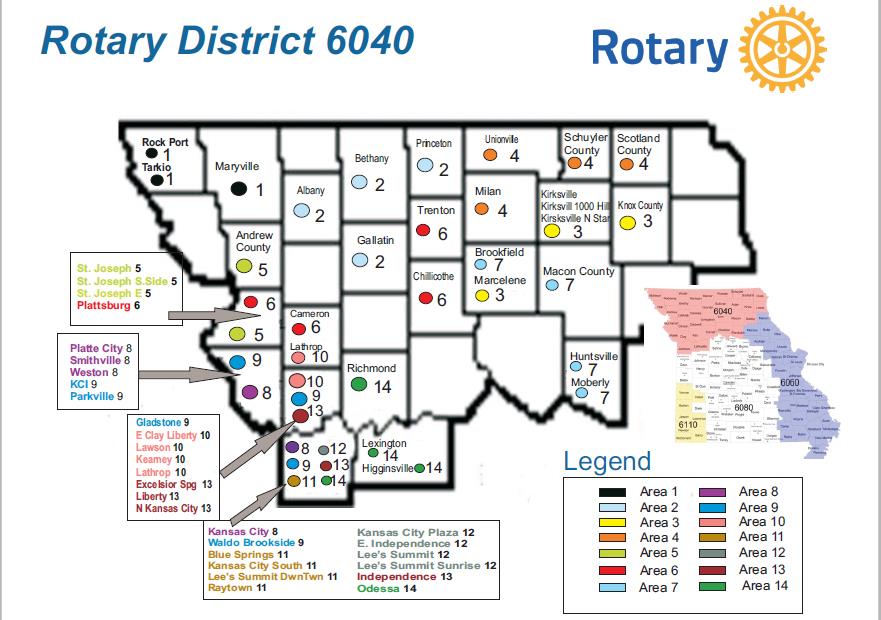

Shoes Cheerleaders in Rotary District 6040 Rotary Clubs –

- This is the week! I look forward to seeing you. Thanks to your club for this 23rd year of participation.

- Thanks for your cooperation toward our currently updated outline for the exciting District 6040 Shoes Caravan 2024. More trailers, more stops!! Find your club below, find your day - for each Rotary community, please let me know if this will work for you, and confirm where to meet.

- Our thanks and gratitude to Kimbal Mothershead who will make available again this year the warehouse space in Liberty to assist in making this all happen! Our partners with UPS will have their trailer at Kimbal’s Liberty warehouse on Wednesday evening, April 17, and will pick up their loaded trailer on Friday evening, April 19.

- If you can volunteer to help load the UPS trailer on Thursday afternoon at 5:00pm, that would be greatly appreciated. Any member, any club, any Interact member, any spouse or friend! Vocational Services Inc., 935 Kent Street, Liberty, MO 64068

- I will also hope to see members from each of your clubs on Saturday morning, April 20 at the FUNvention at Lake of the Ozarks, Margaritaville Resort – your club should be represented at the Shoes Roll Call!

.jpg)

.png)